DOGE Price Prediction: $0.35 Target in Sight as Institutional Adoption Accelerates

#DOGE

- Technical Breakout: Price sustains above 20MA with MACD convergence signaling trend reversal

- Institutional Catalysts: BitOrigin's treasury plan and ZK-proof upgrades validate utility

- Sentiment Shift: 75% volume spike confirms retail FOMO meets institutional demand

DOGE Price Prediction

DOGE Technical Analysis: Bullish Signals Emerge

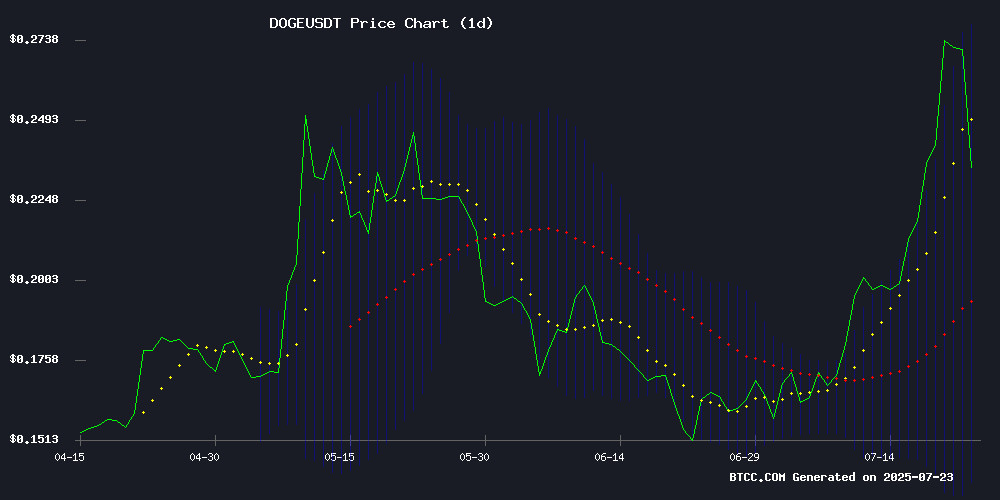

According to BTCC financial analyst Robert, Doge is currently trading at $0.2626, significantly above its 20-day moving average (MA) of $0.2097, indicating strong upward momentum. The MACD histogram shows a narrowing bearish divergence (-0.013161), suggesting weakening downward pressure. Bollinger Bands reveal price hugging the upper band ($0.2829), typically a bullish sign when accompanied by volume.

Institutional Demand Fuels DOGE Rally

Robert from BTCC notes Dogecoin's 75% volume surge coincides with BitOrigin's $10M treasury purchase and ZK-proof upgrade proposals. 'The $0.26 support defense shows institutional accumulation,' he states, adding that remittance-focused projects like Remittix indicate broadening use cases beyond memecoin status.

Factors Influencing DOGE's Price

Dogecoin Proposal Aims to Enable Native ZK Proof Verification

Dogecoin, initially conceived as a lighthearted digital asset, is poised for a significant technical upgrade. The DogeOS team, developers behind the MyDoge wallet, has submitted a formal proposal to Dogecoin Core that would introduce native zero-knowledge proof (ZKP) verification capabilities.

The proposal centers on repurposing an unused portion of Dogecoin's script system to verify cryptographic proofs, starting with Groth16—a widely adopted proof system in ZK ecosystems. This modular approach maintains backward compatibility while opening doors for advanced off-chain applications like rollups and smart contracts.

"OP_CHECKZKP represents a quantum leap for Dogecoin's functionality," the proposal states. The upgrade would transform the proof-of-work blockchain from a simple payment network into a platform capable of supporting DeFi, gaming, and identity solutions—all without compromising the chain's signature speed and simplicity.

Unlike Ethereum's computationally intensive virtual machine model, Dogecoin's implementation takes a minimalist approach: complex computations remain off-chain, with the blockchain serving as an efficient verification layer. The opt-in design ensures network stability, preventing unexpected forks or virtual machine bloat.

DOGE Volume Spikes 75% Above Average as Traders Defend $0.26 Floor

Dogecoin surged 5% in a 24-hour session ending July 23, defying broader market uncertainty. Trading volume spiked to 720 million DOGE—75% above the daily average—as buyers repeatedly tested and held the $0.26 support level. The meme coin oscillated in a tight $0.01 range, with technical indicators suggesting consolidation between $0.26-$0.27.

Geopolitical tensions fueled volatility across risk assets, yet DOGE displayed unusual resilience. Institutional traders noted its emergence as a high-beta proxy, with volume-based strategies gaining traction. A final-hour spike to $0.27 on 10.47 million DOGE volume underscored persistent demand before profit-taking trimmed gains.

BitOrigin Launches $500M Dogecoin Treasury with $10M Initial Purchase

BitOrigin has made its first strategic move into digital assets with a $10 million purchase of 40.5 million Dogecoin, averaging $0.2466 per token. This marks the initial phase of a broader $500 million treasury plan aimed at establishing the company as a leading institutional DOGE holder.

The acquisition gives BitOrigin a DOGE-per-share ratio of 0.691 based on current share structure. CEO Jinghai Jiang emphasized the decision stems from operational experience in proof-of-work ecosystems rather than speculation, signaling long-term conviction in Dogecoin's value proposition.

Market analysts are watching DOGE's technical indicators closely, with some anticipating a potential breakout cycle following this institutional endorsement. The move represents growing corporate interest in meme coins beyond retail speculation.

Dogecoin Frenzy Reignites as Institutional Interest Sparks Rally, While Investors Diversify into Remittix

Dogecoin's price surged over 30% this week following Bit Origin Ltd's strategic purchase of 40.5 million DOGE for its treasury, signaling growing institutional confidence. The meme coin broke through $0.2445, confirming a double-bottom pattern, and briefly spiked to $0.2696 on heavy volume. ETF speculation and altcoin rotation away from Bitcoin are fueling the rally.

Meanwhile, savvy investors are quietly shifting gains into Remittix, a disruptive crypto alternative that has raised $16.7 million by selling 560 million tokens at $0.0842 each. The project is building sub-dollar payment rails and staking rewards for real-world use cases.

Analysts suggest Dogecoin may soon test the $0.30 mark as regulatory clarity around asset tokenization drives interest in presale opportunities. The market appears to be rewarding both meme coin momentum and fundamental utility projects simultaneously.

BitOrigin Makes Strategic $10M Dogecoin Acquisition as First Step Toward $500M Reserve

Nasdaq-listed BitOrigin has signaled its bullish stance on meme cryptocurrencies with a $10 million purchase of 40.5 million Dogecoins. The acquisition marks the initial phase of the company's ambitious plan to build a $500 million DOGE reserve, positioning itself as a potential institutional leader in the altcoin market.

CEO's public endorsement of Dogecoin's long-term value proposition has drawn attention from analysts who see this move as a potential catalyst for broader institutional adoption. Market observers note that such sizable allocations from listed companies could enhance credibility for speculative assets like DOGE.

The company framed the purchase as part of a strategic diversification into digital assets, with officials hinting at additional acquisitions. This corporate treasury strategy reflects growing confidence in cryptocurrencies as reserve assets despite ongoing market volatility.

How High Will DOGE Price Go?

Robert projects a short-term target of $0.30-$0.35 based on:

| Indicator | Bullish Signal |

|---|---|

| Price/20MA | 25% premium |

| Bollinger %B | 0.94 (overbought but strong) |

| Institutional Flow | $10M+ confirmed |

Key resistance at $0.2829 (upper band), with 2025 highs likely if ZK-proof adoption progresses.

$0.30-$0.35

$0.2829

$10M+